How to Charge 10 Times More Than Your Freelance Competition

If you it’s time for you to up your rates, here are four incredibly practical ways to confidently move to charging more.

AND.CO is now Fiverr Workspace

For a business to be successful, regardless of its size, it is essential that it makes a profit. However, the economic result, calculated as the difference between revenues and costs, depends on many factors, so you need to know the break-even formula. In this article, we will show you the costs associated with being self-employed and running a small business, how to calculate your break-even point, and what you need to know about profit to build a sustainable business in the long run.

According to Cox Business, more than half of entrepreneurs start their businesses to follow their passion and to be their own bosses. Although money is not the most important motivator (only 8% of CEOs consider it a major factor in starting a business), very few real businesses find it worthwhile to operate at a loss. Of course, this excludes non-profit organizations and social enterprises. Our focus is for-profit businesses.

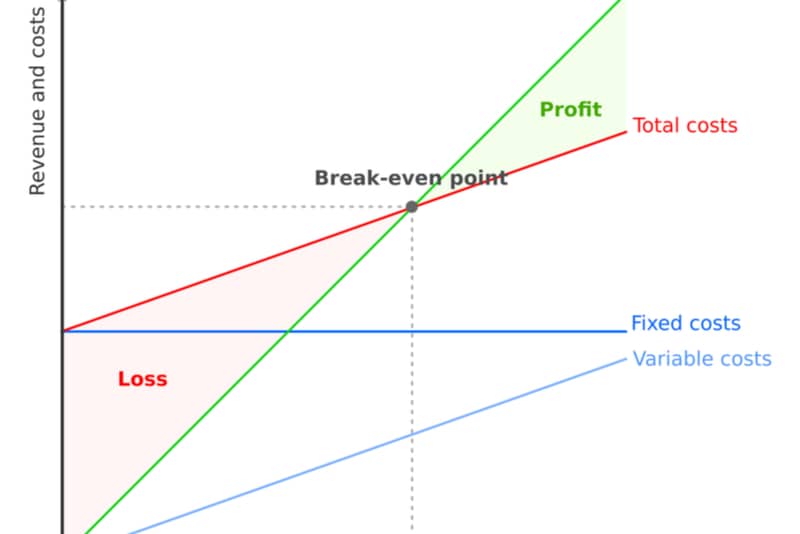

A successful for-profit enterprise is characterized by its profit, i.e., that its revenues exceed its costs. Ultimately, a positive balance sheet at the end of the month determines whether you can build a long-lasting business as a freelancer or SME.

The break-even point is reached when your revenues fully cover the costs of running your business. Once you break even, every dollar you earn becomes profit.

The break-even point is usually calculated both monthly and annually, depending on your industry, location, and individual preferences. For the self-employed,which is what freelancers are in most cases, the annual break-even point is the number of months they have to work and earn revenue to cover their annual expenses.

But why exactly is this indicator important? Well, don’t you want to make a profit? Yes, of course you do! However, with the help of the break-even formula, you can determine how much work you need to do, so your company doesn’t make a loss, which is something you want to avoid as a profit-oriented entrepreneur.

The key benefits of knowing your break-even point:

The calculation seems simple at first, since the break-even point is reached when your income and expenses for a given period equal each other, i.e. their difference is zero.

To calculate this, all you have to do is determine and track your costs for a given period, as you will need to show an equivalent amount of income.

Every business has fixed and variable costs. Fixed costs are those that do not depend, at least not directly, on how many products or services the company sells. Typical fixed costs include labor, the cost of a store or other property, software subscriptions, or overhead in general.

However, it’s reasonable to assume that these expenditures fluctuate over time, since as sales rise, new staff must be employed, and as sales fall, old employees must be laid off. In other words, in the long term, practically all expenses are ultimately variable.

Some goods are fixed costs in one company, while they are variable costs in another. In most companies, electricity costs are fixed: they are more or less the same from month to month: office lighting, printers, a refrigerator in the canteen, and so on. In a bakery, however, the electricity bill is one of the variable costs because most of the electricity is used to heat the ovens, which depends on the amount of bread being baked.

For fixed costs, we assume that they do not depend on the quantity produced or delivered, so they are the same every month, even if you have many customers, and even if you have none.

Our fixed costs will depend heavily on the nature of your business, your location, and your operating model, and only you can accurately determine these. We will show you how to do the math using the example of a freelancer.

Our protagonist is a freelance project manager with years of experience who has multiple clients. They work from home and use their own tools. Let us see how high his fixed costs will be:

For costs like rent, only the time and location apply to the business.

Variable costs are much more difficult for freelancers and small businesses to plan because they rarely know in advance how many products or services they will sell. Therefore, for planning and costing purposes, it pays to set a number that is a realistic/optimistic estimate.

You also need to consider that the unit price may increase or decrease with the quantity sold. A good example of this is the cost of storage, which can be a variable cost for a small business that manufactures and distributes products. You can store 100 products in the rented space you have now; if more orders come in, you will need additional storage space. However, if you need storage space urgently (and temporarily), you may only be able to rent it at a higher cost than, so your total storage cost per product will increase.

An example of the opposite case is a wedding organizer company that can charge its subcontractors lower catering prices as the number of guests increases, so its variable cost per person can decrease.

The most typical variable costs are:

In the case of the freelancer mentioned above, let’s look at what the calculation for a specific month would look like.

Fixed costs:

In total, the monthly fixed costs are $1,800

Variable costs:

For a freelance programmer, there are hardly any variable costs, but for calculation purposes, imagine a software package that is billed per completed project.

The variable cost will be $300 for the 10 submitted projects.

The total cost is equal to the variable cost + the fixed cost, i.e. $2,100 this month.

The break-even point is reached at an income of $2,100. However, it is important to clarify that since we have variable costs, we must also subtract the number of variable costs from each new sale to calculate profit. If we had no variable costs, then each new project would generate a net profit, after $2,100 in revenue.

If we receive another order this month, say $100, our profit will be $100 – $30 = $70.

Break-even pricing is a solution where the price is set not with profit in mind, but to ensure that the sale of the product or service does not result in a loss. This can be useful to your business in two ways. First, it gives you guidance on how to give discounts; second, if your profit is generated by other sales or customers, it allows you to avoid a loss.

The technique of computation is similar to that discussed so far, but the focus is not on computing the monthly or annual zero balance. The fixed and variable expenses are projected to a sold product or service. To do this you will also need a projected figure for the quantity sold.

Our automated technology and intuitive tools take care of the small stuff so you can

focus on what matters