Commonly Missed Tax Deductible Expenses For Your Home Office

If you work from a home office, there are plenty of expenses you can deduct from your tax bill to save money. Don’t miss some of the most common.

AND.CO is now Fiverr Workspace

If you’re reading this blog, you’re probably a self-employed freelancer, solopreneur, etc, and you really like making money.

*raises hand 🙋♀️

Well, making money and saving it come tax time.

*raises hand again 🙋♀️

But then comes the 1,000 tiny details you need to track and organize throughout the entire year…

Managing & organizing all of your expenses & receipts can feel about as fun as creating bibliographies for your old high school essays (remember those? Ew).

Well don’t sweat!

In this post, we’ll dive into why you do need to keep your receipts, but we’ll also share some sweet tips that’ll save you a ton of time tracking & organizing.

Because time is money–and money is money.

Let’s save both 👍

Yes, you do!

If you’re looking to reduce your taxable income, you’ll want to keep evidence of your business expenses for at least three years–and that still applies if your business is reported on your personal tax return (via a Schedule C of course).

From the IRS: How long should I keep records?

Answer: three years.

To be clear, you shouldn’t have to proactively send physical receipts (or copies) proactively to the IRS for all of your business expenses.

However, should you ever have your tax return audited (crosses fingers and knocks on wood), you’re definitely going to want that evidence!

Pro Tip: Make sure to keep bigger expenses especially! If you accidentally trash the receipt for a $11.38 business lunch, don’t fret.

Also, there’s one more huge reason you’ll want to save receipts & track your business expenses…

To make things as easy as possible for yourself come tax time!

April all-nighters spent on taxes = ew.

Creating systems for your receipts, plus staying organized throughout the entire year, can really help you avoid headaches.

Pro Tip #2: Even if you have a CPA who does your taxes for you–saving and organizing your receipts will make their life way easier as well.

They’ll thank you.

Disclosure: Not only are we not accountants, but we’re not your accountants! We can’t be held liable for your own decisions or circumstances. Consult a professional!

Ah yes, the question of the day.

What can I actually deduct as a freelancer or solopreneur??

Here’s a very broad rule of thumb (there are always exceptions of course):

Anything you have to spend–in order to make money.

If you spend money on anything that contributes to your ability to make money from your craft–you should track it (and keep those receipts!)

If you primarily do business online and have a website, or are otherwise a blogger, etc, you should check this post on blogging specific taxes.

First, remember our goal(s):

With that in mind, let’s walk through some tips for making the receipt process stink less.

Make it a habit to capture physical receipts when you receive them.

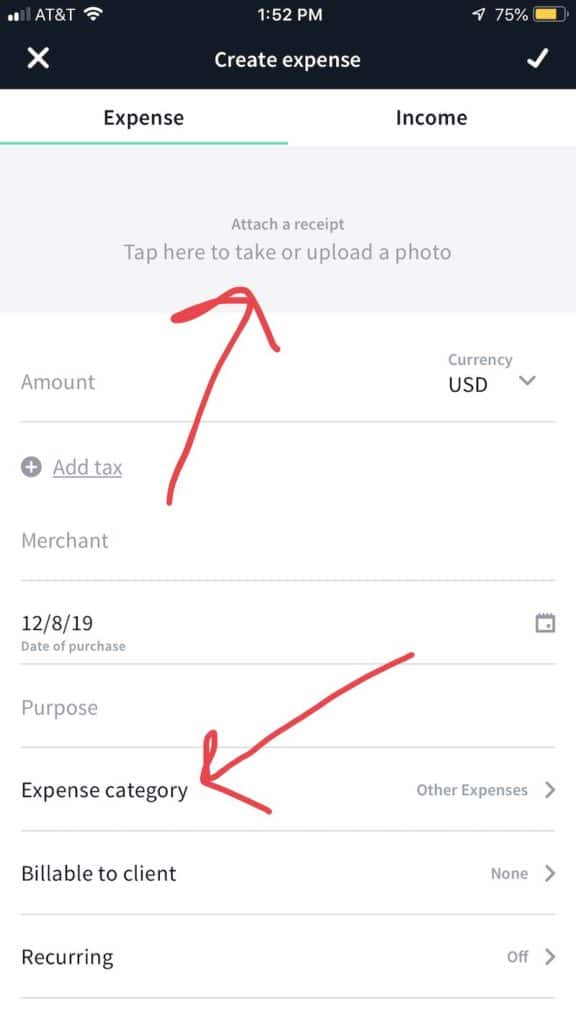

Snapping a picture with your iPhone is ok–but using an app already integrated with your accounting software is way better.

Spoiler alert: The AND.CO app allows to snap a picture and immediately categorizer that expense as well.

The more “work” you can do upfront when you receive a receipt–the less “work” you have to do later.

Re-read that 👆👆

The last thing you want to do with physical receipts is stuff them in your pocket, and throw them into a huge pile at home.

Capture the expense, with an image of the receipt, immediately.

That’ll save time later.

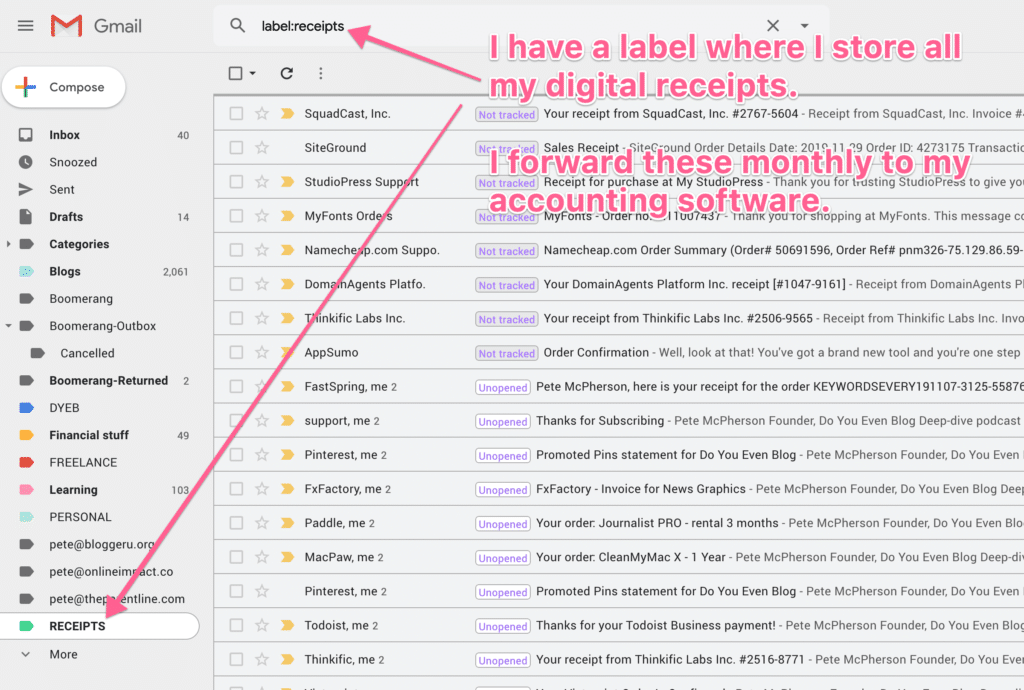

99% of business expenses you’ll purchase online will send you an email receipt.

That’s handy, as long as you set up a system for organizing that stuff!

I know several self-employed folks who live by this system:

Pro Tip: You could also forward receipts to your accounting solution as they come in.

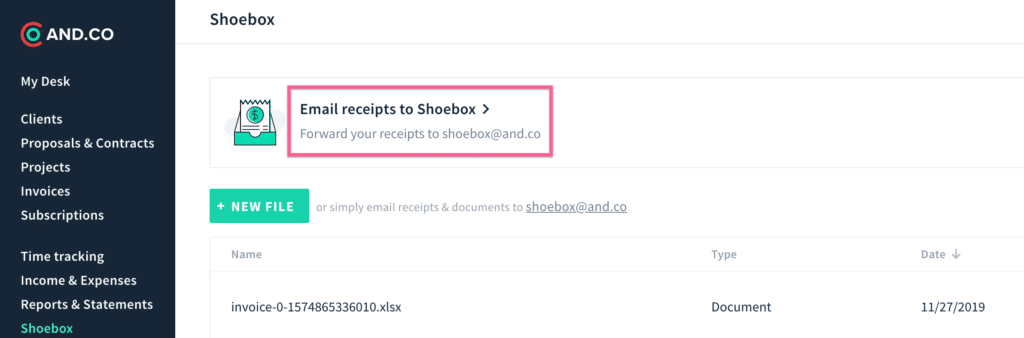

AND.CO users can simply forward their emails to shoebox@and.co, but most other invoicing/receipt tools have some form of this as well.

Even if you do immediately forward email receipts when they arrive–it can still be valuable to have a dedicated “spot” for them in your inbox, etc.

It can be helpful to dive back through your receipts from time to time, so knowing where they’re stored at is step #1 (and that goes for digital and physical receipts).

Let’s pretend that reconciling and categorizing expenses takes you one hour a month.

Does that mean that if you only did it once a year–it would take you 12 hours? Not likely. It’d be a much bigger ordeal.

It’s like going to the dentist. Going consistently is crucial to not having major teeth issues…🦷🦷

Managing, tracking, and categorizing receipts is much easier when you do it bit-by-bit–consistently.

Even if you don’t break down your entire financial statements on a monthly basis, do make it a habit of forwarding email receipts, etc, once a month!

Your future self will thank you 😉

Why does the mafia love dealing with cash so much? It’s hard to track.

I mean–or so I’m told…

When you use a debit or credit card, there is one more layer of records being kept, and this can be super handy if you find yourself missing a receipt for a big expense, etc!

***

The simple system above should already save you some headaches when it comes to tracking your expenses.

But did we miss anything?

As a solopreneur or freelancer–what are some other good habits you’ve found for dealing with business expenses and receipts?

Comment below and teach us a thing or two!

Our automated technology and intuitive tools take care of the small stuff so you can

focus on what matters