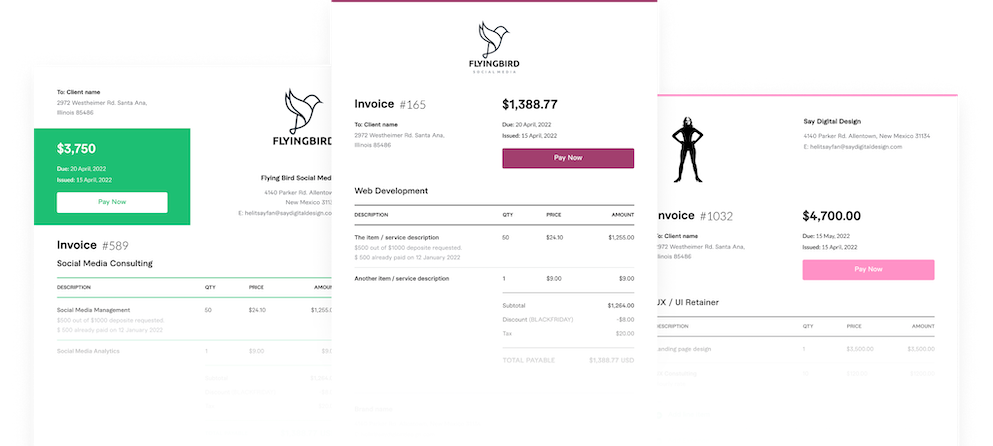

Free Self-employed Invoice Template

If you are self-employed, you can use this template to create a professional invoice for your work. Simply fill the invoice out with your information, download it in whichever format works best for you (.doc, .xls, or .pdf), and send it off.

Invoice Software

Invoice Quicker. Get Paid Faster.

Create beautiful, custom invoices in seconds. Accept payments online, receive alerts in real-time and get paid faster.

Invoice Generator

Create a custom Consultant invoice with a free invoice generator

AND.CO’s invoice maker easily creates attractive, professional invoices that you can download, print or send online in a single click.

FAQ

WHO NEEDS TO USE A SELF-EMPLOYED INVOICE?

Most people who are self-employed will need to send invoices to be paid for their work, because they are not employed by a company who processes payments for them. Many self-employed workers will need to submit multiple invoices to multiple clients engaging their services.

AS A SELF-EMPLOYED WORKER, WHEN SHOULD I SUBMIT MY INVOICE?

When you submit your invoice will depend on the agreement you have with each client, but the most common times to send invoices are as soon as the work is complete, or at the end of the month.

WHAT DO I NEED TO INCLUDE IN MY SELF-EMPLOYED INVOICE?

The specifics of what you include in your invoice depend on the type of work you are doing. However, all invoices require certain pieces of information in order for you to be paid promptly. Those pieces of information are: the name, address, and phone number of the company or person you are invoicing; your name, address, and phone number (or that of your small business); the current date; the date by which you expect to be paid; the method of payment you prefer; a description of the work you did and the cost of each piece of work listed (either a flat fee or an hourly rate); and the grand total, including sales tax if necessary.

WHAT HAPPENS AFTER I SUBMIT MY INVOICE?

After you submit your invoice, you should receive your payment by the date you specified. If you do not receive your payment by this time, check in with the client or company to confirm that the invoice for your work was received. As a self-employed worker, it is important to stay on top of your invoices and ensure that payment is received.