Choosing Appropriate Payment Terms

When setting your payment terms, here are some general options.

Net Days

Net days is the most common payment term for invoices. Net days specifies the number days after the invoice date in which payment is expected. Businesses are free to choose whatever duration they prefer, but by far the most common duration for freelancers are net 30, or net 15 if your cash flow requires faster payments.

Net 30 means payment is due 30 days after the invoice date. Of course, the customer is free to pay any time before the 30 days expires, but after that the account is considered past due.

You can offer a grace period of a few days after your chosen due date has passed. This can help maintain good relations with potentially problematic clients. But generally you’ll want to send a reminder notice once the due date has expired.

Net Days With Discount

If you have difficulties with clients paying late, or waiting until the very end of the invoice payment window to remit a payment, you can add a discount period to your net days term.

This is also helpful if you simply want to offer an incentive for quick payment to help with cash flow. If your normal payment term is net 30, you could offer a discount if paid within 15 days.

A 3% discount would be reflected in your terms as, “3/15 net 30”. The first half describes the discount and the term within which it can be claimed, and the second half denotes the full term deadline for punctual payment.

As with your net days term, you can choose whatever discount and discount period you’re comfortable with.

Use a discount for on time payment, not a late fee for a late payment. It's an age old trick, but it works. Just build it into the pricing from the start. So a $3,000 quote becomes $3,300 with 10% discount if paid in 14 days.

Tim H.,Freelance designer

End of Month

Choosing this term means that the invoice would be due at the end of the month in which the invoice was generated, regardless of the invoice date.

Assuming you adopt this term for all of your invoices, it has the advantage of assuring a relatively predictable, large influx of funds at the end of each month. But it can also feel unfair to clients that receive their invoice at the end of the month, because whether the invoice is generated on the 5th or the 25th, the due date is the same.

This can be unpopular with customers, so perhaps it’s best to only adopt these terms if you can commit to invoicing early in the month.

Month Following Invoice

Month Following Invoice is a way to structure a consistent payment date that avoids the potential for unreasonably short payment windows. You can specify a particular date for payment in the month following the month in which the invoice was generated. Notating “15MFI” means that the invoice is due on the 15th of whatever month follows the current month.

This way, even if the customer’s invoice was sent on the last day of the current month, they’d still have 15 days to pay. The downside to this payment term is that it can be overly generous for invoices generated at the beginning of the month, which can be problematic for cash flow.

Cash on Order, Shipment, or Delivery

Payment terms don’t have to be based on an arbitrary date. You can trigger payment based on specific actions, which can be useful particularly when there’s a transfer of real goods.

Cash on order can be useful when collecting a downpayment. Cash on shipment or cash on delivery require payment when goods are shipped or when they’re delivered.

Due Upon Receipt

Invoices that specify they are Due Upon Receipt are required to be paid the moment they’re received. You might use this for larger projects, where a down payment is required in order for work to commence.

Keep in mind that Due Upon Receipt provides the customer no time to consider the products or services they’ve received before paying, and no window in which to arrange the funds necessary for payment.

Unless you’re in desperate need of cash or awaiting payment for work to commence, you’ll generally want to avoid making your invoices due upon receipt. Consider instead a shorter term net day, like net 15 or even net 10. Giving your clients some sort of window to pay after receiving their invoice is generally a better way to maintain goodwill.

What works for me: I send the client a proposal that outlines my terms (they have to sign it). I take a 50% deposit before I even think about the job. I then invoice the rest when the job is complete (before sending files), or in 4 calendar weeks, or whichever comes first. This has worked for me 98% of the time.

Donna B.,Freelance Graphic Designer

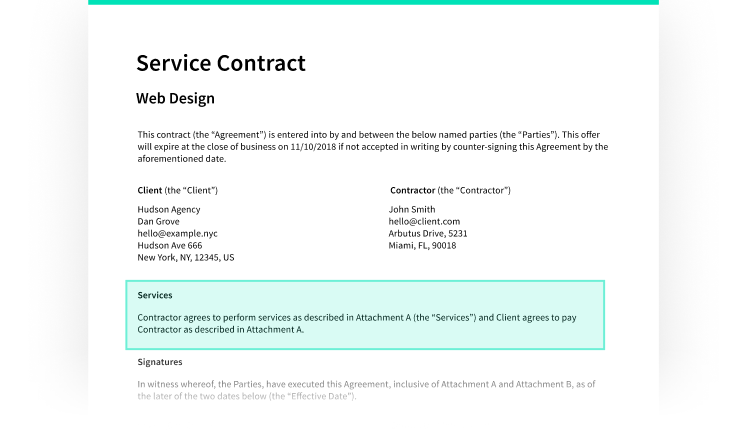

Make certain your payment terms are in your contract

It’s very important that your client is made aware of and agrees to your payment terms before any work commences. The best way to accomplish this is to include all of your payment terms in your initial project contract.

Tight Ts & Cs are essential - as I have found out the hard way. Someone suggested including a clause that even if the agency's client hasn't paid, that’s not your problem.

EM,Freelance Writer

A contract is the best way to protect yourself, and your client, from misunderstandings and from the other party taking unfair advantage. Your contract should spell out the scope of the project, relevant delivery timelines, the costs involved and the required payment terms.

Getting your client to sign off on your payment terms in the contract avoids any uncomfortable conversations later on, and also makes certain your client is planning for the required payment schedule throughout the project.

You’re far more likely to receive a timely payment if the client was made aware of and agreed to your payment terms early on in the process, as opposed to being surprised by them when your invoice arrives. Your client shouldn’t have to guess what your payment terms might be, or make assumptions based on what other vendors generally require. They should know ahead of time.

Should I require a deposit for my freelance work?

Whether you should require a deposit depends to some extent on the sorts of projects you do for a given client. Short duration, low budget projects don’t necessarily warrant a deposit, but certainly for higher budget, longer-term projects you should always require a deposit.

Consider a deposit a hedge against uncertain payment. If your client stiffs you at the end of the project, or cancels at some point in the middle and doesn’t pay, at least you’ll have collected something for your work.

Requiring a deposit also gets your client engaged. They’ll have skin in the game, as it were, so they’re less likely to cancel midway through because they know they’ll lose their deposit and have nothing to show for it. They’ll generally communicate better, get back to you more quickly and be more thorough in their feedback.

Most freelancers require some sort of deposit, and clients are used to being asked for them. Few people will be put off by the request, so simply build it into your contracts as a matter of fact. There’s no need to apologize for it. Your clients will accept it if you make it clear from the beginning that this is how your business operates.

Someone suggested to me to call your first invoice a "commencement invoice" rather than a "deposit". Seems to get it paid faster if the client wants to get started, and it has a non-refundable ring to it. I've been using this and found it quite effective.

Zoe H,Freelance Copywriter

Something between 30% and 50% is a common range for deposits. You don’t want to go too low or you could negate some of the benefits of collecting a deposit. Any higher and your clients may be apprehensive about working with you.

You can also structure deposits as milestone payments. Instead of requiring 50% upfront you could ask for a 25% deposit, another 25% at milestone A, a third quarter at milestone B, and the last quarter upon completion of the project.

This strategy also keeps your client engaged, and assures you a greater share of the agreed upon price as work progresses. It can also feel less onerous to your client than a larger upfront deposit. It means more invoicing and more to keep track of for you, but an invoicing software like Fiverr Workspace will remind you when it’s time to invoice and even create the invoices for you, so it’s super fast to get them out.

Should I charge a late fee?

Late payments are a major contributor to cash flow problems, and anything you can do to limit these is helpful. You know your clients better than anyone, but in general, it’s a good idea to charge a late fee. Late fees disincentivize late payment, which is important to every part of your business. Always make sure the fee is plainly listed on your invoice.

Late fees aren’t necessarily popular with clients, but most businesses will be used to them and understanding of the function they play. Rarely will they be a dealbreaker at the start of a project, and they’re unlikely to cause your client heartache… unless they pay you late, which is the reason you’re charging the fee.

Just make sure you establish your late fee terms early on in the process. Putting the fee into your initial contract is the best way to make certain your clients are aware of your policy before they begin working with you.

Including a late fee in your standard contract also lets your client know you take yourself seriously. If they understand that a late fee is simply a normal feature of your standard contract, clients are less likely to take issue with it. And serial late-payers are less likely to run their games on you if they know there could be repercussions.

Fiverr Workspace’s standard freelance contract, created with The Freelancer’s Union, makes it easy to add late fees into your terms.

By charging a late fee you’re more likely to get paid before other contractors that don’t charge for tardy payments, particularly if the client is making people wait because they’re trying to balance their own cash flow.

It’s also important to remember that just because you include a late fee in your contract, doesn’t mean you always have to enforce it. If a client is honestly having difficulty paying you but is otherwise communicating well and keeps you up to date on their financial situation, it’s okay to give them a break and waive the fee. This creates goodwill and ingratiates you to your client. Without a standard late fee policy you wouldn’t have this opportunity to demonstrate to your client that paying late is not ordinarily acceptable, but that you’re willing to help them out in this instance.

What’s an appropriate late fee charge?

Remember that the purpose of a late fee isn’t revenue generation. You’re just trying to nudge your client into paying on time. The charge shouldn’t be too high or your client may be encouraged to look elsewhere for freelance work.

A common fee is 1.5% interest per month that the invoice is late. This is enough to incentivize proper behavior without leaving the client feeling taken advantage of. The trick is to make certain they blame themselves for having to pay the fee, not you.

How to charge a late fee

If you don’t get paid, send another invoice that includes the original cost with the addition of your late-payment charges. Include a note on the invoice, like “Second notice – 30 days past due.” Continue to follow up until you’ve established a payment plan or received your money.

How to accept payments for your invoices

There a number of payment options available to clients these days and freelancers are smart to accept as many of them as possible. Every client is different, and each may have a different payment method preference.

The easier you make it for your clients to pay, and the more willing you are to accommodate their preferences, the more likely it will be that you’ll be paid on time—and the better your client will feel about the whole experience.

Some of the payment methods you should consider including with your invoices are:

Cash and Checks

You probably won’t find many clients interested in plopping a stack of hundreds on your desk at the completion of the project, but certainly cash is the most liquid form of payment you can accept and should be listed as an option on all invoices.

Check use is becoming less common but you’ll still encounter old school clients that like paying by paper check. Make certain your payment address is on your invoice so the client has an easy reference when mailing in payment.

Credit Cards

Many people use credit cards to settle business invoices. Credit cards give their owners an additional payment window above your payment term, so are often used to help smooth cash flow.

There’s generally a fee involved, but including credit card payments in your list of available options can help get your invoices paid faster.

ACH (Automated Clearing House)

ACH transfers are electronic funds transfers. Direct deposits fall into this category, as do payment services like PayPal, WePay and Stripe. ACH transfers are generally quick ways to process payments but they do require some set up and often involve fees.

With Fiverr Workspace you can set up your own ‘PayMe’ page that allows your client to pay you through these online payment options directly via the invoice at the click of a button.

Wire Transfers

Wire transfers, like those provided by Western Union or Transferwise, are a very speedy way for your client to satisfy their invoice. They’re safe and secure, and transfer funds directly from their bank account to yours. However the fees can add up, particularly for small, one-time payments. Research the best options for your region (and your client’s).

Escrow Services

Escrow services like Fiverr take payment from the client at the start of work and hold it in an escrow account until both parties have agreed that the contract is fulfilled, at which point the funds are released to you. This is a great deal for the freelancer since you are guaranteed payment at the close of the project.

Depending on your client, they may be less enthusiastic about this sort of service. Having to escrow the full payment amount at the start of the project, particularly a large one, could have negative consequences for their cash flow.

Since the payment is released upon completion of the project, using an escrow service is akin to setting your payment terms to “due on receipt”, which can be useful from the freelancer’s perspective. Clients may also like the fact that they are able to confirm that the work has been delivered as promised before funds are released.

How Best to Accept Payments

Each of these payment methods can be set up and maintained by you directly. You’ll need to open an account with each of the payment gateways you’d like to offer, open merchant accounts with each of the major credit cards, and/or supply your customers with the information they’ll need to use each method on their invoice. This requires a bit of maintenance to track payments and make certain the payment methods are behaving properly, but it’s certainly something any freelancer can do.

Given all of the other things you’re tasked to do on a daily basis you may also want to explore other options that are available. Fiverr Workspace lets you set up your own PayMe page to accept all major credit cards and direct deposits directly from your customer’s bank accounts. Apart from looking super professional and being simple for clients to use, it also means you get alerts whenever you’re paid, so you don’t have to worry about keeping track.

With 71% of freelancers having had trouble getting paid, anything that helps your customers pay promptly is worth considering.

Consider your invoice payment terms ahead of time

Take some time to consider which payment terms suit your business best, and set up a standard contract and invoice template that reflect these. This will make it easy to communicate your terms with each of your new clients ongoing.

The most important thing to remember is that no matter how you decide to structure your payment terms, you should always get buy in from your client at the very beginning. There’s no greater invoice foul than surprising your clients with onerous payment terms and expecting them to abide by them.

On the flip side, being upfront and frank about your terms and getting agreement before work begins will help you look professional and win you plenty of respect and goodwill from your clients.