Creating Invoices

Choosing an Invoice Number

The invoice number is one of the first items of information on most invoices. And it’s extremely important because each invoice is identified by the unique number it carries. Both you and your customers (and the IRS, god forbid) will use this number to identify invoices and cross reference them to specific transactions. It’s important that no two invoices ever have the same number, otherwise invoices can get confused, causing problems for everyone. But what’s the best numbering method? There are a few elements to keep in mind.

First, don’t just make up random numbers each time—but that should go without saying. (If it doesn’t, you may want to give your life choices a close examination.)

Sequential numbers:

Sequential numbers are the best way to be certain no two invoice numbers are the same. As an example, a simple sequential numbering scheme might look like this:

001001, 001002, 001003, 001004, etc.

The leading zeros give your numbers room to expand if and when they exceed four digits. Each time a new invoice is generated, the number from the last invoice is incremented by one and assigned to the new invoice.

Referential numbers:

While the sequential method is simple to implement, it’s not very useful, because each invoice ends up with an arbitrary string of numbers that bears no connection to the invoice itself.

Imagine if someone asked you to track down invoice #004755. How would you find it? Where do you start? A simple, sequential string of numbers gives you no frame of reference. You can’t identify who the client was, when the invoice was created, or glean any other useful information that could tell you where to begin looking.

A better method is to encode important invoicing information into your invoice numbering scheme. Invoice numbers aren’t limited to number characters. You can also use letters and certain special characters, like dashes. Use them to give each client a unique code.

-

Using Client Names in Your Invoice Numbers

Your client’s name is ‘Acme Rental’, and you assign them the client code ACM01. The letters are based on the client’s name, and the numbers exist in case you have another client whose name also starts with ACM (who would be ACM02). It’s much easier to track down invoice #ACM01-004755, because you know which client you did the work for.

-

Using Years in Your Invoice Numbers

Other useful identifying information can be baked into your invoice numbers. You might add the year the work was invoiced. Tracking down invoice #ACM01-2019-004755 becomes even simpler, since you’ve narrowed it down to a project you did for Acme Rental in 2019.

Consider creating separate sequential number strings for each client, each year. This helps avoid long strings of digits at the end of each invoice number. So the first invoice you generate for Acme Rental in 2018 would be #ACM01-2018-001. The next would increment at the end to 002.

When you begin the year 2020, your sequential numbers for all clients will reset. So the first invoice for Acme Rental in 2020 would be #ACM01-2020-001.

How to Create an Invoice

In the old days every invoice had to be pressed into wet clay with notched sticks and allowed to bake for hours in the hot sun before they could be delivered by chariot.

That may be going too far back.

In the not quite so old days, every invoice had to be generated by hand. Client contact data, payment terms, project information, and pricing all had to be filled in manually. Invoicing was a huge drag back then. Unfortunately for some people it still is.

Computers have improved this situation tremendously, but there are still better and worse methods for generating your invoices.

You might start by creating a simple invoice in Microsoft Word, but eventually you’ll want to transition to an invoicing system or software that automates some of the work—both to save you time and to ensure that nothing ever gets missed.

Invoice templates

Invoice templates can be in Word documents, Excel spreadsheets, Google Docs or some other predesigned graphical layout with fields for your important invoice information. Templates have the advantage of consistency. Designed with your brand colors and logo included, they maintain a consistent visual quality with each invoice created.

Online invoice generators

There are also online tools that can help create basic invoices for free. For quick, one-off invoices you can use this free online invoice generator to get you started. It contains fields for all the necessary invoicing information and makes it easy to get your invoice properly formatted.

Templates and free online invoice generators get the job done, but they still involve a lot of manual data entry. If you’re a small operation that doesn’t invoice frequently, this may not bother you. Client-specific information can be retained from invoice-to-invoice to save having to input it each time. But project-specific information will have to be translated from contracts into invoice-specific language and manually entered each time an invoice needs creating.

For large, complex projects with multiple components, this not only increases the risk of manual errors, it also adds up to a lot of work—time that could be better spent drumming up new business or getting client work completed.

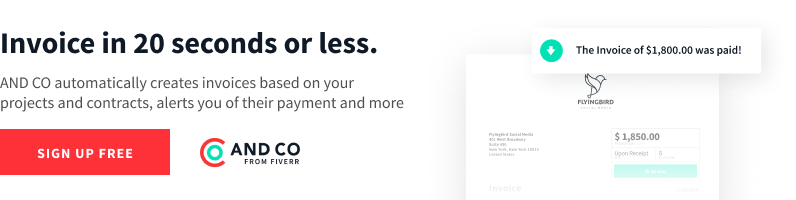

Invoicing software

Tools built specifically to take the drudgery out of invoice creation make the process much more efficient. These software bear serious consideration if you’re a larger organization or if you do a lot of work that requires invoicing.

The time savings alone will more than pay for the software and the reclaimed work hours will help generate extra revenue. Plus, you can deduct the cost of the software from your tax bill—so it’s safe to say that invoicing software is usually a good investment for a freelancer.

Here’s a quick look at how easy it is to send invoices using Fiverr Workspace:

Sending Invoices

When Should You Send an Invoice

You’ve got your invoice created. Now when should you send it? Well, it depends on what kind of invoice you’re sending.

-

Invoices with a deposit:

If you’re looking to collect a deposit—and this can be smart move to hedge against possible client disappearances—then you should invoice before work begins. -

Invoices for services provided in person:

If your services are provided in person then it’s likely your customer expects to be billed immediately. In this case you should invoice upon purchase. -

Invoices for shorter duration projects:

If you’re a freelancer that tends to work on shorter duration projects, then invoicing upon project completion is appropriate. Just give your client a bit of time to make sure they’re happy before hitting them with the bill. -

Invoices for larger projects:

For larger projects that last months or more you may want to consider milestone invoicing. This should be set up ahead of time, with billing milestones pre-determined and agreed upon in the project contract. When a milestone is reached you can send the invoice for that phase of the project. -

Invoices for irregular work:

Finally if you tend to work hourly for clients on an unpredictable schedule it’s best to establish a specific invoicing schedule. Depending on your client’s preferences and your cash flow needs you can bill weekly, biweekly, or monthly. Whichever you choose you should submit your invoice for the previous period’s charges consistently on the chosen schedule.

You should send subsequent invoices based on when you deliver the phases, not when the client replies. That way, if they ghost you at V2, the second invoice is technically still due to be paid because you delivered the work. Have in your invoice terms that you'll send the second invoice 2 weeks after YOU send V1 or V2, whatever works best for you.

I send it after V1 because sometimes clients get side tracked by other things and might not send their revisions to V1. That way if they never send revisions, you never get to V2 and the invoice trigger event, if it's based on V2 delivery.

Besides, 80% of the work is in V1 delivery, so I figure that's a good time to invoice. Helps move the project along.Zoe H,Freelance Copywriter

How to Write an Invoice Letter or Email

It’s a good idea to accompany your invoices with a short letter or email that greets the client, restates the invoice amount, and asks for payment by the agreed upon date. Follow these simple recommendations to generate polished, professional communications.

Keep it Friendly

Whenever you’re communicating with a client about invoicing, it pays to be polite and courteous. “Please” and “thank you” are always a good idea. It’s true that your transaction is reciprocal, but remember that your client can always go somewhere else. Even if the letter is a reminder for a late payment, keep it light and professional.

Keep it Clear

Avoid vague language or wishy-washy requests. Say what you need to say concisely and clearly. As long as you’re polite, your client won’t balk if you’re direct in your requests and expectations. Make certain you’ll be understood. If something can be misinterpreted, you’re not speaking clearly enough.

Keep it Simple

Make it as easy as possible for your client to pay you. Provide payment addresses, PayPal information and any other information needed to get payment processed quickly.

Sample Template

You can use this sample letter to get you started. This would be sent along with a newly created invoice. Alter it as necessary to fit your specific circumstances.

Subject: New invoice available - [your invoice number here]

Message:

Dear [client name],

Hope things are going well for you. You’ll find your latest invoice, number [invoice number here] attached. Please remit [invoice balance] by [invoice due date].

Check payments can be sent to:

[Your address]

Alternately you can PayPal:

[Your email]

Please take the opportunity to look over the invoice at your earliest convenience. I’m happy to answer any questions you might have. Thanks again for your business!

Sincerely,

[Your name]

Making Invoicing Easy

Ultimately, your goal should be to make creating and sending invoices as easy as possible. Invoices are the lifeblood of your business, but if you aren’t careful, they can become a crushing chore that steals valuable time from other priorities.

Choosing a software invoicing tool alleviates quite a bit of the headache and is always a good investment. And sending your invoices out at times appropriate for you and your client, with a friendly email that restates pertinent details, will help maintain a good working relationship and ensure fast payment.