What is an invoice?

An invoice is an itemized bill for services rendered. It’s what you send your client to collect what’s owed to you. It details all of the work you did, the individual prices for various elements, and the total cost. It also contains information such as when the bill is due, where payment should be sent, how late payments are handled and all acceptable payment methods.

Beyond this, an invoice also functions as a transaction record. For the freelancer, it’s a permanent record of the work they completed and what they charged for it. For the recipient, it facilitates an understanding of what the charges represent. Invoices benefit both parties—you want to get paid, and your clients want to know exactly what you’re charging them for.

Types of Invoices

Most of us are familiar with a basic invoice. It’s issued once all work has been completed and requests payment for the full amount owed. But there are other types of invoices that can also be quite useful to the busy freelancer.

Three types in common use are the proforma invoice, the interim invoice, and the recurring invoice. We’ll look at each of these in detail and discuss their purpose, and when it’s best to use them.

What is a proforma invoice?

Proforma invoices can best be thought of as a price quote in an invoice format. They simply describe the services to be provided and list the associated costs. Because the services have yet to be performed, the proforma invoice is not a demand for payment, nor a promise of payment from the client. Proforma invoices aren’t recorded as either account receivables by the seller nor account payables by the buyer.

For freelancers, this sort of invoice is handy for setting client expectations. It lets them know what to expect in terms of deliverables and what they’ll likely be paying for those services. It’s “likely” because the proforma isn’t an official invoice. The totals detailed in the proforma invoice can differ from those in the final, actual invoice, though they shouldn’t depart too far from the quoted amount without ample reason.

The main benefit for the small operator is that proforma invoices can be converted to true invoices fairly easily, which saves time and effort. Since a properly formatted proforma invoice details the work to be done and the costs associated with each item, it takes very little reformating to issue an official request for payment. This can make proforma invoices preferable to other price quote formats.

What is an interim invoice?

An interim invoice is a partial invoice sent during a project. This can help with cash flow for a freelancer or small business. Imagine you’re working on a large project for a client with an inordinately long fulfillment schedule. If you only use a final invoice, that means you have to wait until the very end of the project to get paid. This can be challenging on your cash flow for a number of reasons. While you’ll have to wait until the end to get paid, you may be paying expenses on a continual basis. With nothing coming in to cover these you could find yourself in trouble. Even if your business doesn’t generally have external expenses, you, the person running your business, do. You don’t want to be in a position where you can’t pay your mortgage because you have two months until you can get paid.

Interim invoices solve this problem by allowing you to create a payment schedule. Instead of one single invoice, you’ll send your client invoices on a predetermined schedule, each seeking partial payment of the total job to cover work done in that given period. Without interim invoices, many freelancers can have a difficult time taking on large-scale projects.

What is a recurring invoice?

Recurring invoices are invoices sent to clients at regular intervals. The invoiced amount and the billing interval are negotiated ahead of time.

For freelancers, a recurring invoice could be used for retainer clients. A freelancer might have clients that pay a certain amount every month for specific services. Some might do this to assure that you will drop whatever else you’re working on and focus on them exclusively when they need you to. In exchange for this level of service they pay a monthly premium, which is billed using a recurring invoice.

Others have a set amount of work that you will complete for them each month for the same cost. You simply send them an invoice each month on the same date for the same amount.

What should be included on an invoice?

There are certain pieces of information that every invoice should include.

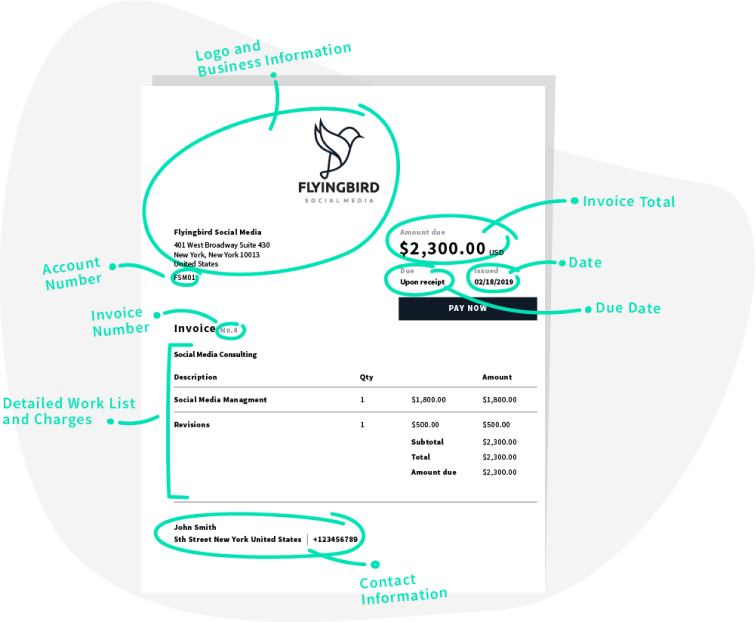

Logo and Business Information

Your invoice header should give your customer a quick snapshot of who is sending the invoice. Include your logo right at the top to make the sender immediately recognizable.

Invoice Number

The invoice number is a unique number which identifies this specific invoice. It doesn’t matter how you number your invoices so long as the numbers are assigned sequentially and no two invoices have the same invoice number.

Account Number

This is your client’s account number or other unique identifying string. If you don’t use account numbers, add your client’s company name here. Remember that invoices are for your client and for you, and having a quick way to identify the client being billed on an invoice is very helpful for the busy freelancer.

Date

The date the invoice was generated.

Due Date

The date the invoice is due. Often this is 30 days from issue but you can set it to whatever you like, so long as the term is agreed upon ahead of time with the client. Optionally you can also say, “due upon receipt” if immediate payment is required.

Invoice Total

It’s a good idea to include the total invoice charge at the top as well as in the detailed work section. The header acts as a snapshot of the invoice, and including the total payment requested at the top makes it easier to find.

Contact Information

Include all of your pertinent contact information such as your address, phone numbers, email address, and website. You want to make it as easy as possible for your client to contact you with questions or payment.

Across from your company information you should add your client’s address and phone numbers as well. This helps you identify who is being billed and is important for your record keeping purposes.

Detailed Work List and Charges

This is the meat of your invoice. This is where you tell your client exactly what you did and how much they’re paying for it. The level granularity can change on a project-by-project basis. For smaller jobs, you might only include a single line item for the entire project.

As an example, your invoice might read:

| Description | Price |

|---|---|

| Q3 sales brochure design | $500 |

For larger or more complicated projects you might list all of the individual components as separate line items. For example:

| Description | Price |

|---|---|

| Business card design | $400 |

| Sale brochure design | $600 |

| Marketing postcard design | $500 |

| Total | $1,500 |

Or, if you’re working hourly, you’ll want to break out the project into its separate, billable tasks and list the number of hours billed for each. Like this:

| Description | Rate | Hours | Price |

|---|---|---|---|

| Graphic design | $50 | 10 | $500 |

| HTML/CSS coding | $75 | 6 | $450 |

| Javascript | $80 | 5 | $400 |

| SEO | $60 | 12 | $720 |

| Total | $2,070 |

How you break up the project should be negotiated with your client ahead of time. You can even use a proforma invoice to establish the parameters before work begins. The most important thing to keep in mind here is that your project breakdown serves both your client and you. Even if your client doesn’t require specificity, you may want to include it for your own records, and to increase clarity in your client communications.

Payment Options

Now you want to make certain your client is aware of all the ways they can pay you. Ideally you want to make payment as convenient as possible to decrease late payment rates.

If you accept cash, credit cards, checks, PayPal or other online payment options, be sure to list them and include any requisite information the client would need in order to take advantage of a given option.

Payment Terms

It’s important to define all payment terms ahead of time so that no one is surprised. It’s easy to sour a relationship by insisting on contract terms that haven’t been previously discussed. As an example, you should mention here how a late payment will be handled, and whether a late fee is charged.

Tax

Depending on where you are doing work, you may need to add tax to your invoice. For example, UK companies may need to add a VAT (value added tax) line item and Australian-based workers may need to add GST (goods and services tax). Be sure to consult with a tax or financial professional for any country-specific requirements you may be obligated to follow.

To generate a quick invoice online using all of these elements, try out this free invoice generator.

What should an invoice look like?

Your invoice needs to look professional. Just like your website, business cards and any other materials you distribute in the course of business, your invoices should feel like they come from a professional that takes their work seriously.

Elements should be arranged in a visually-pleasing way, one that helps with clarity and readability. Information should be grouped together in logical blocks and there should be a sensible flow to the “narrative”.

In a sense, your invoice tells the story of the work you did for your client and its design should help that story make sense and feel valuable.

Of course we’re not all designers. Thankfully there are plenty of free templates online that you can consult for design and layout inspiration. Take a design nod from the brand elements you already have. If your logo has a specific color scheme, you could incorporate this into your layout.

Consistent elements shared across your business collateral will help your branding feel professional.

How often should you invoice?

There isn’t one simple answer to this question. How often you should invoice is determined by a host of factors, some in your control and some not. Ultimately it’s your decision, but here are a few mitigating factors you should keep in mind when developing your invoicing schedule.

The Size of the Invoice

If you’re working on a project that’s worth a lot of money, it makes sense to invoice several times during the project. This will help you keep a positive cash flow while you work. It can also help with your client’s cash flow, and make it more likely that they’ll be able to fork out the money to pay your invoice on time.

Since 71% of freelancers have had trouble getting invoices paid, invoicing frequently is also a form of protection. If you see that a client has difficulty paying early on in a project, you’re able to address the issue before you complete all the work and end up with an unpaid invoice for a sizeable full amount.

For all of the same reasons, jobs that have longer durations may also require frequent invoices rather than one invoice at the completion of the project.

Your Invoicing System

If you’re using an invoicing and expense tracking software, it’s likely that you can create professional-looking invoices easily and quickly. These can be sent electronically directly from your software and, in some cases, allow direct ePayments back to you right through the invoice.

If this is your situation then you can, and should, invoice as frequently as possible. It’s always better to be paid by your clients sooner rather than later, and if invoicing is painless then you have no barrier to timely payment.

If you’re still manually creating invoices through Excel or Word then you’ll likely want to invoice less frequently, otherwise your invoicing may overtake your other job functions, including the work you’re trying to invoice for.

Your Client Count

If you do work for a lot of different clients it can be onerous keeping up with all of the invoices that need creating. It may be better in this case to choose a monthly or bi-monthly schedule, and do all of your invoicing at the same time. This allows you to focus on paying work with the knowledge that, for a few days out of each month, you’ll need to put it down and get your invoicing finished.

Fewer clients allow you more flexibility. You’ll be able to invoice more frequently without impinging on other parts of your freelancing business.

Your Work Volume

If you mainly work on short, small-scale projects, you can get your invoicing done at the end of each job. Depending on your client count, this may be the easiest way to be certain everything that needs invoicing gets invoiced.

However, if you mainly work on larger projects with longer timelines you may want to consider sending interim invoices. This is better for cash flow and keeping a handle on mounting receivables.

Your Record Keeping

If you’re organized and fastidious about keeping tabs on your projects you’re likely able to generate invoices more quickly than if you have to search for the billing information you need. Know yourself. Schedule your invoicing around your strengths. If you’re messy and scattered, make certain you leave yourself time each month to get organized and get your invoicing complete.

Better yet, get yourself permanently organized. You may want to consider an automated invoice tracking software if you’re not terribly good at it yourself.

Fiverr Workspace will help you invoice faster, keep track of your receivables, and minimize errors.

Your Financial Needs

Some months you really need to get paid. Maybe your business encountered some unexpected expenses. If your financial needs necesitate quick payment from as many clients as possible, then invoicing should be a higher priority and you should get it done more frequently. Thankfully you are your own boss, so you have the ability to make this happen.

Balancing your invoices with your freelance work

Remember that freelancing is a balancing act, and you need to square your need to perform billable work with the time needed to invoice for it. Both have to get done eventually.

Monitor your client work and your cash flow and determine a schedule that works for you and your clients. Once you’ve set a schedule you’ll be surprised how much easier it is to stick to.